US-China Trade War to Lower Corporate Benefits: American Author

TEHRAN (Tasnim) – Dean Henderson, author and geopolitical analyst from Missouri, said the threat of an uptick in US-China trade tensions would lead to “higher wages and more jobs” for Chinese and American workers.

“Such a trade war would result in lower corporate profits, higher wages and more jobs for US manufacturing workers, an increase in the value of the yuan and in turn a higher standard of living for Chinese workers who will see their purchasing power increase…,” Henderson told Tasnim.

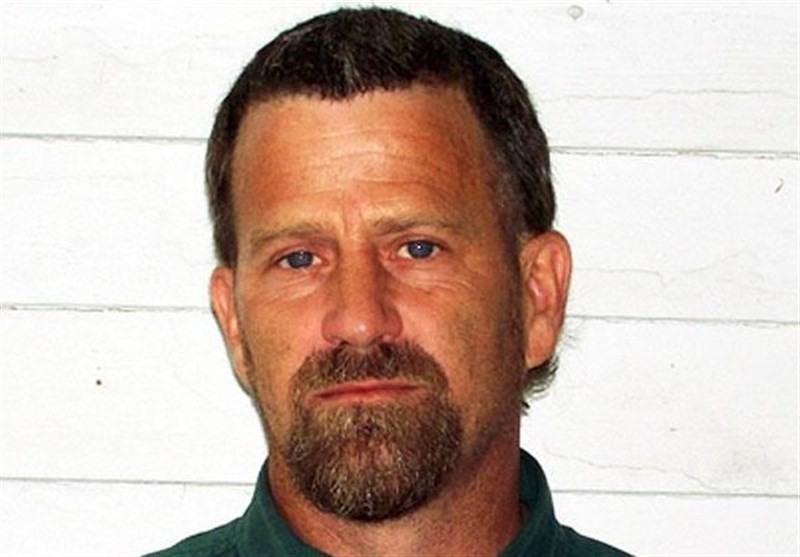

Dean Henderson earned a BLS (Bachelor of Liberal Studies) from the University of South Dakota and an MS in Environmental Studies from the University of Montana. He founded/published/edited one of America’s first political “zines”, The Missoula Paper, in 1990 in Missoula where he was also a regular columnist for the Montana Kaimin. Henderson has traveled to some 50 countries and has written articles for the Global Research, In These Times, Paranoia, Veterans Today, and Rense.com.

He has authored five books. His first book, "Big Oil and Their Bankers in the Persian Gulf: Four Horsemen, Eight Families and Their Global Intelligence, Narcotics and Terror Network" has become a global cult classic among conspiracy researchers. His second book, "The Grateful Unrich: Revolution in 50 Countries" chronicles insights gained from a lifetime of overseas travel. His third book, "Das Kartell der Federal Reserve: Acht Familien beherrschen die Welt", is published is German language by Kopp Verlag. His fourth book, "Stickin’ it to the Matrix", is a practical guide to dropping out of the evil Illuminati system and kicking it in the nuts! His most recent book "The Federal Reserve Cartel", reveals the owners of the world’s private central banks and offers a solution to end their global hegemony over the planet and its people.

Following is the full text of the interview:

Tasnim: As you are aware, US President Donald Trump will impose tariffs on up to $60 billion in Chinese imports to reduce the massive US trade deficit with China and retaliate against the alleged theft of American intellectual property. What’s behind Trump’s decision?

Henderson: Although Trump's foreign policy looks an awful lot like that of both his neo-con and neo-liberal predecessors, his trade policy has caught both of these quite similar establishment wings of guard. The free trade agreements and laisse faire mercantilist policies of this elite class has created an unprecedented disparity of wealth in the US and robbed the US of its manufacturing base. Internationally mobile corporations have made record profits through importing cheap goods from China, while trade unions have been decimated. The undervaluation of the Chinese yuan and exploitation of cheap Chinese labor has made this possible. Calls to raise its value have fallen on deaf ears, so these tariffs may correct this. Of course, the multinationals and bankers don't like this since their profit margins on Chinese imports will fall. This is why the US stock market is headed south.

Tasnim: China has strongly denounced the decision, warning that such measures would put the two economies on course for a trade war. Do you believe that the US is losing its competitive position in world markets and is using unfounded accusation against China as a pretext to impose tariffs?

Henderson: The US lost its competitive advantage long ago when China became the low-wage platform for multinational exploitation. These tariffs may well force the international bankers to revalue the yuan upward. This will help US labor become more competitive and it will also help Chinese workers, who will have more purchasing power vis-a-vis international goods imported into China. Workers in both countries win, while the middleman corporations will see profits decrease as the trade war escalates. When Wall Street goes up, workers see their standard of living decrease, which has happened for decades. When it goes down, it means workers are gaining ground on capital. This balance must be restored, not only in the US but around the world.

Tasnim: Some experts are of the opinion that Trump is externalizing his county’s economic problems to China. Is that so?

Henderson: In this world of globalization, trade policy is extremely important. In the beginning, the US funded its government almost entirely off tariffs imposed on the East India Company and the other mercantilist entities of the European Crowns. Gradually, the tax burden has shifted to working people and away from these multinationals. In a bigger sense, China is not the target here. The corporations who do the importing and exporting are the target. They will pay the extra "tax". So I don't see it as an externalization of a US problem, but a rebalancing of the relationship between global capital and global labor.

Tasnim: What would happen if a trade war takes place between the two countries?

Henderson: Such a trade war would result in lower corporate profits, higher wages and more jobs for US manufacturing workers, an increase in the value of the yuan and in turn a higher standard of living for Chinese workers who will see their purchasing power increase. The era of "free trade" is thankfully over and governments around the world may begin to exert more control over their affairs, control which has been ceded to the WTO (World Trade Organization ) and its elite owners.